Source: http://news.feedzilla.com/en_us/stories/politics/top-stories/267200427?client_source=feed&format=rss

what is autism the giver march 30 rimm george h w bush pauly d project adrienne rich

Source: http://news.feedzilla.com/en_us/stories/politics/top-stories/267200427?client_source=feed&format=rss

what is autism the giver march 30 rimm george h w bush pauly d project adrienne rich

Details about the still-in-alpha Redbox Instant internet movie service have suddenly become more clear, as GigaOm dug up a link to support pages (apparently now password protected) that show off service prices and even screenshots of the website and apps. As noted there, any of this could change before it rolls out to the public, but they show off an unlimited subscription that goes for $6 per month, with a smaller catalog than what Netflix offers, but with recent flicks like Iron Man 2 and Thor. For $8 ($2 more) per month, customers add credits for four DVD rentals each month (no rollover), while video on-demand access to movies starts at $0.99 and goes up. In a disappointing move for Linux users, it appears Redbox and Verizon have selected Silverlight for the web player just like Netflix, instead of Flash like Amazon's Instant Video. Currently, Android, iOS, Xbox 360 and Samsung's Smart TV platform are on deck for apps (check out more screens at the source link) and the page suggests that public launch could come December 17th. Assuming these details hold up, is this enough to pull you away from Netflix / Amazon Prime / Hulu Plus, or maybe add-on another subscription to the pile?

Source: GigaOm

Source: http://feeds.engadget.com/~r/weblogsinc/engadget/~3/cJLbDDeST0g/

robin thicke mariana trench transcendental meditation trayvon martin obama care miss universe canada don draper

7 hrs.

Jonathan Stempel

Two former stock brokers at a Connecticut financial services company were charged with criminal insider trading on Thursday over a 2009 acquisition by computer giant IBM Corp.

U.S. authorities said Thomas Conradt, David Weishaus and three unnamed colleagues made more than $1 million in illicit gains by trading in shares of SPSS Inc before IBM agreed on July 28, 2009, to buy the Chicago-based software company for $1.2 billion.

The criminal indictment details a trail of instant messages involving the men about their activity, some of which refer to other insider-trading cases involving homemaking doyenne Martha Stewart and the billionaire Mark Cuban.

Prosecutors said the scheme got its start with a tip from an associate at the New York law firm that represented IBM in the transaction. Prosecutors did not name the law firm, but Cravath Swaine & Moore has said it was IBM's representative.

"Thomas Conradt, David Weishaus and their co-conspirators engaged in a chain of illegal tipping simply because they wanted to get rich quick," federal prosecutor Preet Bharara said in a statement.

Conradt, 34, is a lawyer living in Denver, while Weishaus, 32, lives in Baltimore. At the time of the alleged insider trading, both were employed at Euro Pacific Capital Inc, a Westport, Connecticut-based firm, according to the Financial Industry Regulatory Authority.

Conradt and Weishaus were arrested by the Federal Bureau of Investigation Thursday morning, an FBI spokesman said.

They were each charged with three criminal counts of securities fraud and one criminal count of conspiracy in an indictment unsealed in U.S. District Court in Manhattan.

They face up to 20 years in prison and a $5 million fine on each of the securities fraud counts. Both are expected to make initial appearances in federal courts near where they live.

The U.S. Securities and Exchange Commission filed related civil fraud charges against both men.

Sharon Feldman, a lawyer for Conradt, did not immediately respond to a request for comment. Michael Grudberg, a lawyer for Weishaus, declined to comment.

Euro Pacific Capital and Cravath did not immediately respond to requests for comment. Armonk, New York-based IBM did not immediately respond to a similar request.

IBM agreed to pay $50 per share for SPSS, a 42 percent premium to SPSS' closing price on the day before the purchase was announced.

According to court papers, Conradt's roommate, an Australian equities analyst, had learned about the pending acquisition from a close friend, a New Zealand citizen who worked as an associate at the New York law firm.

Investigators said Conradt then tipped Weishaus, who in turn tipped three colleagues, who were not named in court papers. These five people placed the various improper trades in SPSS stock and options, according to the court papers.

The indictment outlines a series of instant messages involving the defendants that prosecutors said reflect their involvement in the improper trades.

In one exchange, according to the indictment, Conradt on July 1, 2009, told Weishaus, "Jesus, don't tell anyone else ... we gotta keep this in the family."

Weishaus then said, "I don't want to go to jail," said "Martha Stewart spent 5 months in the slammer," and alluded to an SEC insider-trading case against Cuban, the owner of the Dallas Mavericks pro basketball team.

On July 23, Weishaus refused to buy SPSS call options for Conradt, prompting Conradt to write, "I'm setting this deal up for everyone ... making everyone rich," according to the indictment.

The criminal case is U.S. v. Conradt et al, U.S. District Court, Southern District of New York, No. 12-cr-00887. The SEC case is SEC v. Conradt et al in the same court, No. 12-08676.?

Source: http://www.nbcnews.com/business/2-charged-insider-trading-over-2009-ibm-deal-1C7337954

staten island chuck dr jekyll and mr hyde edwin jackson punksatony phil 2012 groundhog day groundhog phil pee wee herman

Every Wednesday, we publish our ?Investor Toolkit? series. Whether you?re a new or experienced investor, these weekly updates are designed to give you specific advice on investing in the stock market and other investment topics. Each Investor Toolkit update gives you a fundamental piece of our investment strategy, and shows you how you can put it into practice right away.

Tip of the week: ?Starting out with a handful of good stocks and adding steadily to them as your portfolio grows in value is the way most successful investors reach their goals.?

The right number of stocks to have in your portfolio will vary over time. The number should grow as you advance in your investing career.

Pick at least one stock from each of the 5 sectors. At the outset, you should aim to invest in a minimum of four or five stocks. Our advice is to pick one from each of the five main economic sectors (Manufacturing & Industry; Resources; Consumer; Finance; and Utilities). If you cannot manage to buy a stock in each one, you should still look to cover most of them.

You can buy them one at a time, over a period of months or even years, rather than all at once. After that, you can gradually add new stocks to your portfolio as funds become available, taking care to spread your holdings across sectors in line with our advice.

Add new stocks as your portfolio?s value increases. When your portfolio gets into the $100,000 to $200,000 range, you should aim for perhaps 15 to 20 stocks. If you?re married, it?s best to treat your family holdings as one big portfolio, even if you and your spouse keep your money separate (for our advice on treating all your investments as a single portfolio see last week?s Toolkit: View the article here). That way, you can be sure you aren?t operating at cross purposes, or investing too much of the family fortune in a single area.

Use our 3-part advice as a guide. When you get above $200,000 or so, you can gradually increase the number of stocks you hold. When your portfolio reaches the $500,000 to $1 million range, 25 to 30 stocks is a good number to have.

Of course, you may fall a few stocks short of that range, or go a few above it, particularly when you?re making changes in your holdings. That won?t matter if you follow our three-part approach to investing: invest mainly in well-established companies; spread your money out across the five main economic sectors, and downplay stocks that are in the broker/media limelight.

Our upper limit for any portfolio is around 40 stocks. Any more than that and even your best choices will have little impact on your personal wealth.

COMMENTS PLEASE?Share your investment experience and opinions with fellow TSINetwork.ca members

Do you have many more stocks now than you had during the first few years you were investing? Was there a period during which you added a large number of stocks? Was there a period when you made significant cuts in your stock portfolio? Let us know what you think.

Be the first to comment.

denver weather planned parenthood what time does the superbowl start kobayashi margaret sanger paul george eddie long

I?ve written before about my recent experience in a parenting class based on Positive Discipline (rather than authoritative or permissive parenting). Apparently, this approach is really beneficial for kids with special needs. To read more, go to Parenting Style Has Big Impact on Kids with Disabilities.

And have I ever mentioned here how much I love David Simon?s HBO series The Wire and Treme (set in New Orleans)? Well, I found out why when I read Wired Magazine?s interview with Simon and he explained that he writes his shows for people who like to read stories in books (which is to say, stories that take 300-pages to relate rather than 40 minutes of TV). ?The interview is worth reading in its entirety for Simon?s thoughts on the significance of cities and the importance of telling stories over time.

I was also intrigued by NPR?s recent story about how kids learn in the east and in the west. Over here, we tend to think intelligence falls into our heads. Over there, they tend to think you work hard at it. Over here, we tend to value creativity. Over there, they score higher on science exams. We all have something to learn from one another.

And one more: Loving a Child on the Fringe, a wise (and critical) reflection on Andrew Solomon?s Far from the Tree by the mother of a child with Down syndrome. To leave you with one quote:

?The joy Eurydice takes in each detail of life is the most infectious quality I?ve ever known. When she flings her arms around my neck as she does every day, every night, my most recurrent fear is no longer relapsing cancer, no longer early dementia or heart disease or hearing loss?or even the fact that Eurydice is growing up too slowly. It is a testament to how radically this child has transformed me that my most recurrent fear may be that she?s growing up too fast?that one day she could be too mature to give me those massive, resplendent, full-body hugs.

Source: http://www.patheos.com/blogs/thinplaces/2012/11/worth-reading-on-parenting-tv-and-learning/

arizona governor patrick witt leprosy tampa bay buccaneers birdman whip it gabby giffords

A whizbang in the insurance and financial worlds for decades, a spry retiree in Chicago was the last guy his children imagined they'd see snared in a money scam.

But in a mere month earlier this year the 80-year-old grandfather was conned out of an estimated $25,000.

"It might even be more," his oldest son said.

Once the victim's kids caught on, the scam got scarier.

"These people threatened to kill me on more than one occasion," the son said.

Still, they want their father's story told. To protect their identity, Yahoo News is not naming the elderly victim or his family.

"If it can happen to my dad, it can absolutely happen to anyone else," the son said.

Federal officials agree and are sounding the alarm. A government report released this month described elder financial exploitation as an "epidemic with society wide repercussions." While this type of fraud is woefully underreported and often overlooked, officials estimate that Americans 65 and older are taken for nearly $3 billion a year.

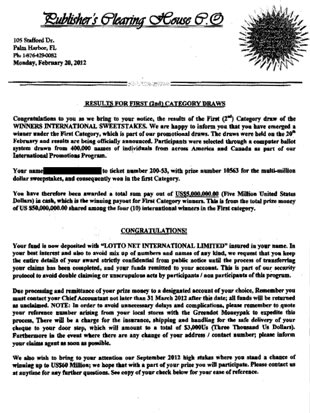

Elder fraud comes in all forms, including the lottery scam pulled on the Chicago widower. A Feb. 20 letter in the style of Publishers Clearing House sweepstakes informed the widower he'd won at least $5 million. To claim his prize, the letter said, he would need to send $3,000 to cover "insurance, shipping and handling for the safe delivery."

He complied, but the fraudsters kept calling back for more. Time and again, he'd go to neighborhood stores and wire money by the hundreds and thousands. In mid-March, one of his children paid a visit and spotted money transfer receipts scattered about.

Fraud letter sent to Chicago victim

Fraud letter sent to Chicago victim

"My dad became hush-hush and actually tried to hide stuff," the son told Yahoo News. "That was totally out of character for my dad. And he came up with a BS story that my brother did not believe."

His children alerted the Illinois attorney general, Publishers Clearing House and the financial institutions involved. MoneyGram and Western Union blocked the 80-year-old's accounts, but he continued to get calls from strangers in New York and Jamaica. His sons intercepted some of the calls, which turned threatening when the sons refused to put their father on the phone.

"They said they could see us through the window, that they were going to shoot us that afternoon," his son said.

The family and others familiar with the case believe the original fraudsters sold the victim's information on "smurf lists" so that other money launderers could contact him as well. One female caller told the son she was his father's girlfriend. Others knew personal details about the elderly man, like his dog's name.

"Anything to get through to my dad," he said. "They're good, they're organized and they are ruthless."

Chris Irving, assistant vice president of consumer and legal affairs at Publishers Clearing House, says imposters are a thorn in the company's side.

"Our efforts to get the criminals to stop using our name are numerous," Irving said. "And at the end of the day, perhaps the most effective deterrent is the comprehensive education we provide to consumers through many different programs that reminds them that if you have to pay to win, it is not a legitimate prize and it is certainly not from the real Publishers Clearing House."

[RELATED: Yellow pages scammers ordered to pay back $10M]

Nine months later, the man's children are still puzzled by how their financially astute father fell for the scam.

"My dad was and is still in denial," the son said. "He told the police that it was a very small amount, but we know he fibbed."

Shame and fear of losing their independence keeps elders from reporting such crimes, but Pamela Teaster, a gerontologist, says executive function is often the first sign of cognitive decline for seniors.

"That's where that sort of reasoning and dealing with numbers issue comes into play," said Teaster, who heads the University of Kentucky's Justice Center for Elders and Vulnerable Adults.

Criminal gangs are noticing the growing elder population in the United States.

"They have the nation's wealth," Teaster said. "That's where the money resides."

The Government Accountability Office recently called on the Federal Trade Commission, Justice Department, Health and Human Services and other federal agencies to step up efforts to combat elder financial exploitation.

"It calls for a more cohesive and deliberate approach government-wide that, at a minimum, identifies gaps in efforts nationwide, ensures that federal resources are effectively allocated, establishes federal agency responsibilities, and holds agencies accountable for meeting them," the GAO report concluded.

"Often the response has been disjointed," Sen. Richard Blumenthal, D-Conn, said in a speech at the inaugural meeting of the Elder Justice Coordinating Council in October. The new multiagency federal council is charged with creating a better road map for elder justice.

[RELATED: N.J. gay conversion therapy group sued for fraud]

Cases like the one in Chicago often fall through the cracks because of overlapping local, state and federal jurisdictions or limited resources for law enforcement. Privacy and antitrust laws complicate matters too.

Publishers Clearing House and money transfer companies already report fraud to the government. But Kim Garner, MoneyGram's senior vice president of global security, said more crime patterns could be identified if the FTC would allow for certain fraud details to be mutual across business and law enforcement networks.

"If we could come up with new ways of sharing information that doesn't violate antitrust or privacy laws, that would be a step in the right direction," said Garner, a former Secret Service agent.

Garner and her MoneyGram team already help police where they can, and are constantly updating their computer system to try and catch fraud before a transaction is complete.

"Because the bad guys get really good at the rules," she said.

No one knows that better than the Chicago victim and his family.

After their father was blocked from wiring money, the shysters convinced him to open new checking and savings accounts. The cons gained online access, but were stopped before they could play switcheroo with his money.

"God only knows what he might have lost," the son said.

Fraud resource links:

? File a complaint with the FTC

? MoneyGram's fraud prevention tips

? FBI advice for senior citizens

bosom buddies diplo rodney atkins fergie one republic michael dyer suspended new years ball drop

1. Your order is usually shipped out within 12-48 hours after your payment is received. We will deliver your order by USPS - Worldwide Express Mail Service (Online Tracking). And it normally will arrive within 5~7 working days;

2. The tracking No. of your Parcel will be sent to you after your order is despatched. You may use the tracking number to check the status of your order online;

3. Shipping fee is ??7.99 per order (will be converted to other currency based on your choice), no matter how many items you purchase in your order. The shipping fee will be auto-added in the grand total when you send payment;

4. We cannot deliver your order to a P.O. Box address, so be sure to give us a street address.

Source: http://www.friendshipbraceletssale.co.uk/sale-links-of-london-bangles-silver-classic-two-heart.html

Tony Scott UFC 151 empire state building prince harry Hurricane hunger games Ronda Rousey

Foreign Exchange Hedging -?

International Trading - to hedge or not to hedge ??

The Foreign Exchange Market - International Finance.

Future payments or distributions payable in a foreign currency carry the risk that the foreign currency will depreciate in value before the foreign currency payment is received and is exchanged into U.S. dollars. While there is a chance of profit from the currency exchange in the event the price of the foreign currency

Increases, most investors and lenders would give up the possibility of currency exchange profit if they could avoid the risk of currency exchange loss.

The foreign exchange market comprises the spot market and the forward or future market. The spot market is for foreign exchange delivered in two days or less. Transactions in the spot market quote rates of exchange prevalent at the time of the transactions. A bank will typically quote a bid and offer rate for the particular currency. The forward market is for foreign exchange to be delivered in three days or more. In quoting the forward rate of currency, a bank will use a rate at which it is willing to buy the currency (bid) and a rate at which it will sell a currency (offer) for delivery, typically one, two, three or six months after the transaction date.

Non-Hedging Techniques to Minimize Transactions Exposure

Two obvious ways in which transactions exposure can be minimized, short of using the hedging techniques described below, are transferring exposure and netting transaction exposure. The first of these is premised on transferring the transaction exposure to another company. For example, a U.S. exporter could quote the sales price of its product for sale in Germany in dollars. Then the German importer would face the transaction exposure resulting from uncertainty about the exchange rate. Another simple means of transferring exposure is to price the export in Deutsche Marks but demand immediate payment, in which case the current spot rate will determine the dollar value of the export.

A?second way in which transaction risk can be minimized is by netting it out. This is especially important for larger companies that do frequent and sizeable amounts of foreign currency transactions. Unexpected exchange rate charges net out over many different transactions. A receivable of 100 million Deutsche Marks owed to a U.S. company in 45 days is much less risky if the U.S. company must pay a different German supplier 75 million Deutsche Marks

Foreign Currency Risk: Minimizing Transaction Exposure

The risk is reduced further if the business has only receipts in Deutsche Marks on a continuing basis. Transaction exposure is further reduced when payments and receipts are in many different currencies. Foreign currency values are never perfectly correlated. Therefore, an unexpected increase in the value of the French Franc may improve the profit margin on receipts from France. However, an unexpected decrease in the value of the Canadian Dollar may reduce profits on a receipt from Canada. Although transaction exposure cannot be completely netted away, it may be small enough that the company is better off accepting the exposure rather than incur the costs associated with the hedging techniques described below.

Reducing Short-Term Foreign - Currency Risk

Forward Contracts

The most direct method of eliminating transaction exposure is to hedge the risk with a forward exchange contract. For example, suppose a U.S. exporter has sold 50 cases of wine to a Venezuelan company under a sales contract that specifies the payment of 15 million bolivares in 60 days. The U.S. exporter can eliminate its transaction exposure by selling 15 million bolivares to its bank at a 60-day forward rate of 750 bolivares per dollar. No matter what happens to the exchange rate over the next month, the company is assured of being able to convert the 15 million bolivares into U.S $20,000. If the U.S. business faced an account payable instead of a receivable, it could eliminate its transaction exposure by buying the bolivares at the forward rate.

However, the transaction exposure is eliminated only if the Venezuelan buyer pays its 15 million bolivares obligation. A default by the Venezuelan buyer would not relieve the U.S. producer of its obligation to deliver 15 million bolivares to the bank in return for U.S.$20,000. The U.S. exporter would have to buy the 15 million bolivares at the spot rate two months later.

Forward rate contracts are often inaccessible for many small businesses. Banks often tend to quote unfavorable rates for smaller business because the bank bears the risk the company will not fulfill the forward rate contracts. Large spread in the forward rate quote suggests unfavorable offer terms. Banks will refuse to offer forward contracts at any rate to uncreditworthy companies. Companies that is not eligible for forward rate contracts have the option, however, of hedging transaction exposure with futures contracts.

Futures Contracts

In principle, no differences exist between a futures market hedge and a forward market hedge. For example, a U.S. business has an account payable for $50,000 Canadian, due on the third Wednesday in September. The company could buy one September Canadian Dollar futures contract. If the value of the Canadian dollar increased, the U.S. dollar value of the company?s account payable would increase, resulting in a reduction in the company?s value. However, the value of the futures contract would increase by an equal amount, leaving the net value of the company unchanged. If the value of the Canadian Dollar decreased, the U.S. dollar value of the payable account would increase, but the value of the futures contract would decrease by an equal amount.

A?U.S. business with an account receivable for Canadian Dollars would hedge its position by selling short the Canadian Dollar futures contract. A short sale of a future contract puts the business in a position opposed to that of a business owning the futures contract. When the futures contract increases in value, the company loses that amount. When the futures contract decreases in value, it gains that amount. Despite their advantages, futures contracts also contain some disadvantages. Because futures contract are marked to market on a daily basis, any losses must be made up in cash on a daily basis, while the offsetting gain on the currency transaction will be deferred until the transaction actually occurs. This imbalance can result in a severe liquidity crisis for small companies and for individuals.

Another disadvantage of using futures contracts for hedging is that they trade only in standardized amounts and maturities. Companies may not have the choice of timing their receivables and payables to coincide with standardized futures contracts. Consequently, the hedges are not perfect.

Hedges Using the Money Market

A company has the alternative of using a money market hedge if forward market hedges are not available or too expensive, and where a futures market hedge carries too much risk of insolvency. A money market hedge?called that way because it necessitates borrowing or lending in the short-term money market?enables a company with a future receivable or a future payable to make the required exchange of currencies at the current spot rate. For example, suppose a U.S. exporter expects to receive four million Brazilian reals in one month from a Brazilian customer. The business could eliminate uncertainty about the rate of currency exchange by borrowing reals in Brazil at an interest rate of 10 percent per month: The company can convert the reals into U.S. dollars at the spot rate. When the Brazilian customer pays the four million reals one month later, it is used to pay off the principle and interest accrued on the loan in Brazil.

The difference between the borrowing and the lending interest rates is the cost of a money market hedge. In general, companies must pay more to borrow funds than they can receive when they lend funds. In turn, banks lend funds at a higher interest rate than they pay for funds to earn a profit. The interest rate increases if default risk is present. Banks often require borrowers to pledge the receivable as collateral on the loan to guard against default risk. If the receivable presents a low risk, the bank will require a lower interest rate. If the business is borrowing for a future payable, it can pledge the reals deposit as collateral. When the bank?s risk is low, the company?s borrowing and lending rates are close to the risk-free rate. In this case, even if forward and futures contracts are available, a money market hedge may be the least costly hedging alternative.

Options

Currency options give one party the right, but not the obligation, to buy or sell a specific amount of currency at a specified exchange rate on or before an agreed-upon date. If the exchange rate moves in favor of the option holder, the option can be exercised and the holder is protected from loss. On the other hand, if the rate moves against the holders, it can let the option expire, but profit, by selling the foreign currency in the spot market.

Consequently, options are best characterized with potential for gain and no downside risk. Hedging in the options market enables businesses and individuals to reduce loses caused by unfavorable exchange rate changes, while preserving gains from favorable exchange rate changes. However, this flexibility has a cost.

For example, a U.S. importer must pay a Venezuelan company 150 million bolivares on the third Wednesday of December. The importer is concerned about large losses that would be incurred if the value of the bolivar increases before the obligation is paid. The current value of the bolivar is 710 bolivares per dollar, so the importer buys a December call option for 150 million bolivares at an exercise price of $0.00139 per bolivar. The importer must pay $0.00005 per bolivar plus a broker?s commission of $40.00. If by the third Wednesday in December the value of the Bolivar falls to 725 bolivares per dollar, then the U.S. importer discards the option and buys the 150 million bolivares at the new spot rate for $206,897.

The total cost to the company would be the commission plus premium, plus cost of exercise totaling $214,437.00 ($40 commission, plus $7500 commission, plus $206,897.00). If the value of the bolivar rises above $.00139, the company exercises the call option and buys the 150 million bolivares at the exercise price of $0.00139 per bolivar and pays $208,500 to satisfy the account payable. Under this scenario, the total cost to the company never exceeds the total of the commission plus premium, plus cost of exercise totaling $216,040.00. If the importer has a bolivar-denominated receivable account, it can purchase a bolivar put option. The put option gives the importer the right to sell the bolivar that it receives to the writer of the option at the exercise price specified in the option contract. Consequently, the company is guaranteed a minimum total dollar amount in the future that is equal to the exercise value of the option less the premium and commission paid for the put option. If the value of the bolivar rises, the firm discards the put option and receives the new dollar value of the bolivar receivable less the amount or premium and commission paid on the option. While option hedges suggest a win-win situation for the company, the real benefits of the hedge are somewhat in question. Whether or not the option is exercised, the company always bears the option premium and commission costs. Nevertheless, the company replaces an unknown and potentially disastrous loss with a smaller, but certain, cost. If the option market is efficient, the net monetary benefit of an option hedge to the company is negligible or even slightly negative due to transaction costs. The company gains from the reduction in uncertainty.

The option market?s efficiency is best understood from the seller?s (writer?s) vantage point. The option seller has no gain and all the risks of a loss. Consequently, the only way in which the option seller is induced to write an option is by the holder being willing to pay a premium. Consequently, option premiums reflect the equilibrium price at which an option buyer and option seller perceive their respective interests are protected. The premium is the compensation for differences in expected payoffs.

Cross Hedging

Thus far, a market for forward rates, futures contracts, credit or options in the foreign currency being hedged has been presumed to exist. But this may not be true in all cases, especially for small developing countries. In such cases, cross hedging may be the only hedging alternative available.

Cross hedging is a form of a hedge developed in a currency whose value is highly correlated with the value of the currency in which the receivable or payable is denominated. In some cases, it is relatively easy to find highly correlated currencies, because many smaller countries try to peg the exchange rate between their currency and some major currency such as the dollar, the franc or euro. However, these currencies may not be perfectly correlated because efforts to peg values frequently fail.

As an example, a company has a payable or a receivable denominated in the currency for a small nation for which there are no developed currency or credit markets. The company would explore the possibility that the currency is pegged to the value of a major currency. If not, the company would look at past changes in the value of the currency to see if they are correlated with changes in the value of any major currency. The company would then undertake a forward market, futures market, money market, or options market hedge in the major currency that is most closely related to the small nation?s currency. Cross-hedging success depends upon the extent to which the major currency changes in value along with the minor currency. Although cross hedging is certainly imperfect, it may be the only means available for reducing transaction exposure.

Mitigating Long-Term Currency - Risk Exposure

Theoretically, the same hedging instruments discussed above to alleviate short-term currency risk can be used to hedge long-term transaction exposure. However, at present, there is a limited market for currency futures options with maturities greater than one year. A few multinational banks offer long-term forward exchange contracts with maturities as long as seven years. Unfortunately, for smaller companies, only large, creditworthy corporate customers qualify for such contracts. Although individual companies can negotiate a currency option contract, there is no secondary market for the instrument. Consequently, a number of alternative hedging techniques have developed for reducing long-term transaction exposure.

Back-to-Back Loans

Multinational corporations can often reduce their respective long term currency risk exposure by arranging parallel or back-to-back loans. For example, suppose a U.S. company wants to buy into a fertilizer project in Argentina that will repay the investment and earnings in pesos over the next seven years. The U.S. investor is confident of the rate of return in pesos, but wants to avoid the risk the value of the peso in dollars will decline, resulting in a negative return in dollars. If it can identify an Argentine company that wants to make a similarly sized investment in the U.S., it can arrange offsetting loans. The Argentine company will lend the U.S. company pesos and the U.S. company will lend the Argentine company dollars with which to make their respective investments. The U.S. company will repay the Argentine firm with its peso earnings, and the Argentine company will repay the U.S. firm with its dollar earnings.

Under this arrangement, the companies are entering into a purely bilateral arrangement outside the scope of the foreign exchange markets. Neither company is affected by exchange rate fluctuations. Nevertheless, both companies remain exposed to default risk because the obligation of one company is not avoided by the failure of the other company to repay its loan.

Currency Swaps/Credit Swaps

Swaps are like packages of forward contracts. Currency swaps can be used to avoid the credit risk associated with a parallel loan. In broad terms, a currency swap is an agreement by two companies to exchange specified amounts of currency now and to reverse the exchange at some point in the future. The lack of credit risk arises from the nature of a currency swap. Default on a currency swap means that the currencies are not exchanged in the future, while default on a parallel loan means that the loan is not repaid. Unlike a parallel loan, default on a currency swap entails no loss of investment or earnings. The only risk in a currency swap is that the companies must exchange the foreign currency in the foreign exchange market at the new exchange rate. Frequently, multinational banks act as brokers to match partners in parallel loans and currency swaps.

However, finding companies whose needs mutually offset one another is difficult, imperfect and only partially reduces currency exposure risk. If a company cannot find a match, a credit swap may be used. Credit swaps involve a deposit in one currency and a loan in another. The deposit is returned after the loan is repaid. For example, a U.S. business could deposit dollars in the San Francisco branch of an Asian bank, which would, in turn, lend the depositor yen for an investment in Japan. After the Asian bank loan is repaid in yen, the dollar deposit would be returned.

Summary

Effective legal drafting can minimize significant international transaction risk. However, the risk of currency exposure can be mitigated or even eliminated in its entirety by the techniques and instruments described in this article. How much currency risk exposure remains depends on the instrument selected. Many instruments do not hedge transaction exposure perfectly, but are more accessible to the individual and small to medium size companies. Instruments used to more completely hedge currency exposure, such as put and call options, may contain sizeable transaction costs. Nevertheless, most international businesses prefer the certainty of minimizing exposure, despite the increased transaction costs involved, in lieu of unquantifiable and potentially disastrous foreign exchange risk.

A money market hedge?called that way because it necessitates borrowing or lending in the short-term money market?enables a company with a future receivable or a future payable to make the required exchange of currencies at the current spot rate.

Although cross hedging is certainly imperfect, it may be the only means available for reducing transaction exposure.

Source: http://www.fmdynamics.com/2012/11/currency-risk-of-international-trade.html

tim howard west virginia rob roy gaslight justin timberlake michael dyer bachmann

With the help of federal mediators, the NHL and the players' association got back to bargaining Wednesday after a week apart.

The location was secret, and so was what was discussed. The talks went well enough that the sides will be back at the negotiating table Thursday.

"No comments," was all NHL deputy commissioner Bill Daly would say Wednesday night in an email to The Associated Press.

This marked the first meeting between the sides since a get-together that lasted just over two hours last week in New York after the locked-out players' association made a new comprehensive proposal that was quickly rejected by the NHL. The sides agreed on Monday to use the Federal Mediation and Conciliation Service.

The lockout, which reached its 74th day Wednesday, has already forced the cancellation of all games through Dec. 14, the New Year's Day Winter Classic, and All-Star Weekend that was slated for Columbus, Ohio, in January.

blake griffin dunk on kendrick perkins kendrick perkins steve jones emily maynard kola boof burmese python national signing day

Three UK has announced that it's begun stocking the 3G/HSPA version of Google's Nexus 7. The ASUS-made 7-inch tablet will be available from today at Three retail stores and the network's website -- although the device isn't anywhere to be found on Three's site at the time of writing.

Three says it'll sell the 3G Nexus 7 for an up-front fee of £49.99 on a £19.99 per month contract, which includes a 5GB monthly data allowance. Spec-wise, you're looking at the same Nexus 7 we've known since June -- stock Jelly Bean on a 7-inch display, with 32GB of storage.

The 3G Nexus 7 has proved successful in the short time it's been available. The device was briefly sold out on the UK Google Play Store before more stock arrived this Monday.

Source: Three

Source: http://feedproxy.google.com/~r/androidcentral/~3/QC1MxOZueSs/story01.htm

evan longoria ryan seacrest kentucky derby beltane capitals john edwards conocophillips

NEW YORK (AP) ? A nanny accused in the stabbing deaths of two children in her care at their upscale home near Central Park pleaded not guilty Wednesday inside a hospital room where she's been treated for self-inflicted stab wounds.

Yoselyn Ortega, lying handcuffed in her hospital bed in silence, her right hand trembling, entered the plea through her defense attorney.

"I ask you to enter a not guilty plea on behalf of my client," attorney Valerie Van Leer-Greenberg said.

Van Leer-Greenberg also told Judge Lewis Bart Stone that her client needed constant medical care.

"My client ... sustained serious medical injuries and mental trauma," she said. "She's lying in a hospital bed. She has a neck brace, and her hand that you can see is shaking. She is in a very debilitated condition."

The judge, like two prosecutors and everyone else crowded into the room, wore a hospital gown and a blue hair net. He ordered Ortega held without bail while she undergoes a psychiatric exam.

Ortega, 50, appeared alert but didn't speak during the 10-minute hearing. The judge placed her on suicide watch.

Ortega, who's from the Dominican Republic, had a neck brace and a tube leading to her throat but breathed on her own. No wounds were visible; a white hospital blanket was pulled up to her chest.

The hospital room was sparse: There were no flowers, photos or other personal items on display.

The unusual bedside arraignment came as District Attorney Cyrus Vance Jr. announced an indictment charging Ortega with multiple counts of murder.

"This crime shocked and horrified parents around the city, many of whom entrust their children to the care of others both by necessity and by choice," Vance said in a statement. "My heart goes out to the family of those beautiful young children, and I hope that, with time, this family will heal."

Authorities allege that on the evening of Oct. 25, while the children's mother was out with a third child, Ortega repeatedly stabbed 6-year-old Lucia Krim and her 2-year-old brother, Leo Krim.

When their mother, Marina Krim, returned to the family's Manhattan home with her 3-year-old daughter, she found their bodies in the bathtub, with Ortega lying on the bathroom floor with stab wounds to her neck, authorities said. A kitchen knife was nearby.

The children's father, CNBC digital media executive Kevin Krim, was away on a business trip when the killings occurred.

The couple's apartment building sits in one of the city's most idyllic neighborhoods, a block from Central Park, near the Museum of Natural History and blocks from Lincoln Center for the Performing Arts. The neighborhood is home to many affluent families, and seeing children accompanied by nannies is an everyday part of life there.

Some of Ortega's friends and relatives said she appeared to be struggling emotionally and financially recently, but they still couldn't believe she could have committed such a heinous act.

Source: http://news.yahoo.com/ny-nanny-pleads-not-guilty-2-kids-knife-224516136.html

PlanetSide 2 Alexis DeJoria danica patrick sweet potato casserole christina aguilera Pumpkin Pie Recipe turkey

Sorry, Readability was unable to parse this page for content.

j.k. rowling j.k. rowling axl rose google earnings pat burrell hilary rosen grilled cheese

By Liana B. Baker

NEW YORK (Reuters) - Groupon Inc (NasdaqGS:GRPN - News) Chief Executive Andrew Mason, under fire for a plunging share price and tapering growth, declared on Wednesday he would fire himself if he ever thought he was the wrong man for the job.

Mason, whose performance at the helm will come under scrutiny from his board of directors during a regular board meeting Thursday, said it would be "weird" if they did not. But he said he believed the board was comfortable with his strategy.

Shares in the company, once touted as innovating local business advertising through the marketing of Internet discounts on everything from spa treatments to dining, surged 8 percent to $4.25 in the afternoon.

"It would be more noteworthy if the board wasn't discussing whether I'm the right guy for the job," Mason said in an interview from a Business Insider conference in New York. "If I ever thought I wasn't the right guy for the job, I'd be the first person to fire myself."

"As the founder and creator of Groupon, as a large shareholder..., I care far more about the success of the business than I do about my role as CEO," he said.

Groupon has shed four-fifths of its value since its public trading debut as an investor favorite during last year's consumer dotcom IPO boom, and Mason himself has presided over a string of high-profile executive departures.

Wall Street has grown uneasy about the viability of its business as fever for daily deals has cooled among consumers and merchants, hurting its growth rate.

In the interview broadcast from the conference, the outspoken and sometimes-zany co-founder argued his company was going through a period of volatility but believed it was on the right path. Groupon's efforts to reduce its reliance on plain vanilla deals include bumping up its "Goods" retail business, increasing the selection of "persistent" or long-running deals, and allowing users to search for such deals on demand.

Shares in Groupon spiked after the interview and were up 8 percent at $4.26, still way below its $20 market debut price.

Groupon and rivals in the daily deals business, like Amazon.com-backed (NasdaqGS:AMZN - News) LivingSocial, were supposed to change the very nature of small-business advertising. Instead, they were forced to revamp their business models as evidence mounts that their strategy was flawed.

This month, Groupon reported another quarter of disappointing earnings, and its stock went as low as $2.60 on November 12.

Europe has been a particular problem for Groupon, partly because the sovereign debt crisis has sapped demand for higher-priced deals. Groupon was also offering steeper discounts, turning off some European merchants.

International revenue, which includes Europe, grew just 3 percent to $277 million in the third quarter, while North American revenue surged 80 percent to $292 million.

Adding to its difficulties, the U.S. Securities and Exchange Commission is looking into Groupon's accounting and disclosures, areas that raised questions among some analysts during its IPO.

But Mason shrugged off speculation that the company might run into a cash crunch and go bankrupt. The company has said it had $1.2 billion in cash and equivalents with no long-term debt.

"There was a period when those stories started that I'd go to my CFO ... and say: 'how would that happen, walk me through what would be required for us to actually go bankrupt'," Mason said. "And it's like an end of days, apocalyptic scenario. The business would have to go into severe negative growth for something like this. The scenario is so absurd there's no evidence for it."

(Reporting By Liana Baker; Editing by David Gregorio, Tim Dobbyn and Marguerita Choy)

Source: http://news.yahoo.com/groupons-mason-under-fire-fire-185640542.html

st bonaventure ncaa tournament 2012 peyton manning 49ers andy pettitte tyler clementi kevin kolb sarah shahi

A recent announcement sparked a hysteria which divided the Facebooking world into two factions: users who suspected the email was yet another scam; and users who believed that Facebook is rolling back copyright and privacy rights, and protested this by cutting-and-pasting a viral status update.

Source: http://www.msnbc.msn.com/id/3036697/vp/49971575#49971575

limbaugh aaron smith wilt chamberlain joe arpaio cat in the hat green eggs and ham wiz khalifa and amber rose

Forced treatment for people with mental illness has had a long and abusive history, both here in the United States and throughout the world. No other medical specialty has the rights psychiatry and psychology do to take away a person?s freedom in order to help ?treat? that person.

Forced treatment for people with mental illness has had a long and abusive history, both here in the United States and throughout the world. No other medical specialty has the rights psychiatry and psychology do to take away a person?s freedom in order to help ?treat? that person.

Historically, the profession has suffered from abusing this right ? so much so that reform laws in the 1970s and 1980s took the profession?s right away from them to confine people against their will. Such forced treatment now requires a judge?s signature.

But over time, that judicial oversight ? which is supposed to be the check in our checks-and-balance system ? has largely become a rubber stamp to whatever the doctor thinks is best. The patient?s voice once again threatens to become silenced, now under the guise of ?assisted outpatient treatment? (just a modern, different term for forced treatment).

This double standard needs to end. If we don?t require forced treatment for cancer patients who could be cured by chemotherapy, there?s little justification for keeping it around for mental illness.

Charles H. Kellner, MD unintentionally provides a perfect example of this double-standard in this article about why he believes electroconvulsive therapy (ECT, also known as shock therapy) shouldn?t be held to the same standards as FDA-approved drugs or other medical devices:

Yes, ECT has adverse effects, including memory loss for some recent events, but all medical procedures for life-threatening diseases have adverse effects and risks. Severe depression is every bit as lethal as cancer or heart disease. It is inappropriate to allow public opinion to determine medical practice for a psychiatric illness; this would never happen for an equally serious nonpsychiatric illness.

And yet, strangely enough, if someone were dying from cancer or heart disease, they have an absolute right to refuse medical treatment for their ailment. So why is it that people with mental disorders can have that similar right taken away from them?

People who?ve just been told they have cancer are often not in their ?right? minds. Many people never recover from that information. Some rally, undergo treatment, and live a long and happy life. Others feel like they?ve been given a death sentence, resign themselves to the disease, and refuse medical treatment.

As long as they do it in the quiet of their home, nobody seems to much care.

Not so with mental disorders. No matter what the concern ? depression, schizophrenia, bipolar disorder, heck, even ADHD ? you could be forced into treatment against your will if a doctor thinks it may help you. Technically, he or she must also be concerned about your willingness to live, but isn?t an oncologist also concerned about their patient?s will to live?

I?ve wrestled with this double standard all my professional life. Early in my career, I believed professionals had the right to force a person to undergo treatment. I rationalized this position ? as most psychiatrists and psychologists do ? arguing to myself that since many mental disorders can cloud our judgment, it seems like something that may be appropriate from time to time.

I was never fully comfortable with this idea, though, because it seemed completely antithetical to the basic human right of freedom. Shouldn?t freedom override the right to treat someone, especially against their will?

After talking with hundreds of people over the years ? patients, clients, survivors, people in recovery, advocates, and even colleagues who voluntarily underwent psychiatric treatment procedures such as ECT ? I?ve come to a different point of view. (Luckily, it appears ECT treatment is in decline and may someday go the way of the dodo bird.)

Forced treatment is wrong. Just as no doctor would ever force someone to undergo cancer treatment against their will, I can no longer back the rationalizations that justify forcing a fellow human being to undergo treatment for their mental health concern without their consent.

As a society, we?ve shown time and time again that we cannot devise a system that won?t be abused or used in ways that it was never intended. Judges simply don?t work as check for forced treatment, because they don?t have any reasonable basis on which to actually rest their judgment in the short time they?re given to make a determination.

The power to force treatment ? whether through the old-style commitment laws or the new-style ?assisted outpatient treatment? laws ? cannot be trusted to others to wield compassionately or as an option of last resort.

What should be good enough for the rest of medicine should be good enough for mental health concerns. If an oncologist can?t force a cancer patient to undergo life-saving chemotherapy, there?s little that can justify our use of this type of power in psychiatry and mental health.

It?s a double-standard in medicine that has gone on long enough, and in modern times, has outlived its purpose ? if it ever even had one.

Dr. John Grohol is the CEO and founder of Psych Central. He is an author, researcher and expert in mental health online, and has been writing about online behavior, mental health and psychology issues -- as well as the intersection of technology and human behavior -- since 1992. Dr. Grohol sits on the editorial board of the journal Cyberpsychology, Behavior and Social Networking and is a founding board member and treasurer of the Society for Participatory Medicine.

Dr. John Grohol is the CEO and founder of Psych Central. He is an author, researcher and expert in mental health online, and has been writing about online behavior, mental health and psychology issues -- as well as the intersection of technology and human behavior -- since 1992. Dr. Grohol sits on the editorial board of the journal Cyberpsychology, Behavior and Social Networking and is a founding board member and treasurer of the Society for Participatory Medicine.Like this author?

Catch up on other posts by John M. Grohol, PsyD (or subscribe to their feed).

????Last reviewed: By John M. Grohol, Psy.D. on 26 Nov 2012

????Published on PsychCentral.com. All rights reserved.

APA Reference

Grohol, J. (2012). The Double Standard of Forced Treatment. Psych Central. Retrieved on November 27, 2012, from http://psychcentral.com/blog/archives/2012/11/26/the-double-standard-of-forced-treatment/

?

Source: http://psychcentral.com/blog/archives/2012/11/26/the-double-standard-of-forced-treatment/

gary carter dies oolong tea survivor one world lil kim progeria what will my baby look like gary carter died

A large part of Australia news readers is made by Businessmen who are dependent on Australia?s Business news that offer them with the latest ups and downs in Share market and condition of market, so that they will be able to sterilize their business through the changing business strategies. It offers its readers seeking Business news with the latest news on Stock market, Banking Insurance and Corporate news.

With increasing crime cases India we can see crime rate rising. The only hope is knowledge and common goal of social sufficiency. With new time it is hoped that things in Bihar would also take a dramatic turn. New reign seems determined in its efforts as mentioned proudly in Bihar news. Politics can be good also if bad. Our readers have access to stories all around India that enable them to not only know what is going on in the world but also to assist them to gain insight into what the people of other states are thinking and help them to rediscover themselves according to the changing conditions. Without even being told we get aware about wrongs and rights the way we grow up.

Some particularly innocent victims leave their doors unlocked even after they?ve been invaded through unlocked doors. It?s not always easy to find sympathy for such wanton carelessness, but we must remember, after all, that they are indeed innocent victims in both senses of the word. In fact, the surviving victims themselves usually are in blind denial of the blatantly obvious and brutal truth that their contributory negligence led to such anguish. It happens more often than not in heinous crimes it?s human nature, a coping mechanism. If you meet these questions about crime, you can ask criminal lawyer and compensation lawyer for help, and compensation lawyer will deal with your personal rights well.

Source: http://www.gongyifair.org/please-protect-us-in-the-social-crime.html

iCarly banana republic gap Victoria Secret Bath And Body Works Dicks Sporting Good office max

ScienceDaily (Nov. 26, 2012) ? Electronic circuits are typically integrated in rigid silicon wafers, but flexibility opens up a wide range of applications. In a world where electronics are becoming more pervasive, flexibility is a highly desirable trait, but finding materials with the right mix of performance and manufacturing cost remains a challenge.

Now a team of researchers from the University of Pennsylvania has shown that nanoscale particles, or nanocrystals, of the semiconductor cadmium selenide can be "printed" or "coated" on flexible plastics to form high-performance electronics.

The research was led by David Kim, a doctoral student in the Department of Materials Science and Engineering in Penn's School of Engineering and Applied Science; Yuming Lai, a doctoral student in the Engineering School's Department of Electrical and Systems Engineering; and professor Cherie Kagan, who has appointments in both departments as well as in the School of Arts and Sciences' Department of Chemistry. Benjamin Diroll, a doctoral student in chemistry, and Penn Integrates Knowledge Professor Christopher Murray of Materials Science and of Chemistry also collaborated on the research.

Their work was published in the journal Nature Communications.

"We have a performance benchmark in amorphous silicon, which is the material that runs the display in your laptop, among other devices," Kagan said. "Here, we show that these cadmium selenide nanocrystal devices can move electrons 22 times faster than in amorphous silicon."

Besides speed, another advantage cadmium selenide nanocrystals have over amorphous silicon is the temperature at which they are deposited. Whereas amorphous silicon uses a process that operates at several hundred degrees, cadmium selenide nanocrystals can be deposited at room temperature and annealed at mild temperatures, opening up the possibility of using more flexible plastic foundations.

Another innovation that allowed the researchers to use flexible plastic was their choice of ligands, the chemical chains that extend from the nanocrystals' surfaces and helps facilitate conductivity as they are packed together into a film.

"There have been a lot of electron transport studies on cadmium selenide, but until recently we haven't been able to get good performance out of them," Kim said. "The new aspect of our research was that we used ligands that we can translate very easily onto the flexible plastic; other ligands are so caustic that the plastic actually melts."

Because the nanocrystals are dispersed in an ink-like liquid, multiple types of deposition techniques can be used to make circuits. In their study, the researchers used spincoating, where centrifugal force pulls a thin layer of the solution over a surface, but the nanocrystals could be applied through dipping, spraying or ink-jet printing as well.

On a flexible plastic sheet a bottom layer of electrodes was patterned using a shadow mask -- essentially a stencil -- to mark off one level of the circuit. The researchers then used the stencil to define small regions of conducting gold to make the electrical connections to upper levels that would form the circuit. An insulating aluminum oxide layer was introduced and a 30-nanometer layer of nanocrystals was coated from solution. Finally, electrodes on the top level were deposited through shadow masks to ultimately form the circuits.

"The more complex circuits are like buildings with multiple floors," Kagan said. "The gold acts like staircases that the electrons can use to travel between those floors."

Using this process, the researchers built three kinds of circuits to test the nanocrystals performance for circuit applications: an inverter, an amplifier and a ring oscillator.

"An inverter is the fundamental building block for more complex circuits," Lai said. "We can also show amplifiers, which amplify the signal amplitude in analog circuits, and ring oscillators, where 'on' and 'off' signals are properly propagating over multiple stages in digital circuits."

"And all of these circuits operate with a couple of volts," Kagan said. "If you want electronics for portable devices that are going to work with batteries, they have to operate at low voltage or they won't be useful."

With the combination of flexibility, relatively simple fabrication processes and low power requirements, these cadmium selenide nanocrystal circuits could pave the way for new kinds of devices and pervasive sensors, which could have biomedical or security applications.

"This research also opens up the possibility of using other kinds of nanocrystals, as we've shown the materials aspect is not a limitation any more," Kim said.

The research was supported by the U.S. Department of Energy and the National Science Foundation.

Share this story on Facebook, Twitter, and Google:

Other social bookmarking and sharing tools:

Story Source:

The above story is reprinted from materials provided by University of Pennsylvania.

Note: Materials may be edited for content and length. For further information, please contact the source cited above.

Journal Reference:

Note: If no author is given, the source is cited instead.

Disclaimer: Views expressed in this article do not necessarily reflect those of ScienceDaily or its staff.

snl Election Election results 2012 exit polls Presidential Polls California Propositions Electoral College

There?s much more to muscle building than simply going to the health and fitness center or buying devices to work with in your house. You have to know the proper way to exercise so that you can achieve this safely and securely and properly. Keep reading for some Miles Austin Jersey tips about how to construct your muscles.

If you really want to construct some considerable muscle mass, you should think about using a creatine monohydrate health supplement. Not all people advantages from the usage of these kinds of products, however they could lead to increased muscle tissue growth and therefore are worth trying. Should they usually do not do the job, then it is no decrease.

Take advantage of tribulus terrestris so that you can get muscle mass. This specific nutritional supplement can boost your muscles growth and cause considerable upgrades within your durability. Try and consume at the least 250 milligrams as well as a highest of 750 mg twice each day. One dosage must be an hour prior to exercising.

Sleep days and nights are as essential as exercise routine days. If you are caring for your muscle groups seven days weekly, not only will you Miles Austin Jersey get psychologically burned up out, however, your entire body will cease responding properly. You should relax at least two days and nights weekly and permit your muscles to unwind.

Be sure that you are successfully instruction your primary. This doesn?t suggest merely undertaking managing techniques or exercising-soccer ball crunches. Try out carrying out an business expense barbell squat. This exercising is a very hard one which puts a lot of desire in your entire primary due to the weight?s placement. Carrying this out transfer on a regular basis can help you in raising much more on other huge exercises.

Improving the fullness of your respective tricep muscles is really important. Despite the fact that cord click downs is very effective, for you to do Miles Austin Jersey expense moves to get actual tricep mass. Rearing the biceps and triceps more than your mind permits you to stretch the lengthy go from the tricep, that allows it to deal superior to if the biceps and triceps have reached your aspects.

Attempt to keep a record when following an exercise regimen. Jot along the exercise routines you do, the number of sets and repetitions you need to do, and everything else concerning your exercise routine. You must write down just how much sleep you receive each night and in many cases your emotions while in workouts. Recording every little thing that one could enables you to greater monitor how you are carrying out every full week.

Involve branched-chain aminos in your daily diet. These particular amino acids, that happen to be called BCAAs, include isoleucine, valine, and leucine. They guide your body make and fix any muscle tissue that?s been damaged, and so they offer you energy whilst training. Take in at least Miles Austin Jersey about three gr plus an optimum of five with the your morning meal, before your workout, following your workouts, and correct before going to get to sleep.

Seeing that you?ve check this out article, you have to know the best options for constructing your own muscles. Use the recommendation you just read through to help you quickly start building muscle groups. Have some fun, and make sure to pass through this advice through to Miles Austin Jersey someone else who demands it so they can get pleasure from the benefits of developing muscle groups effectively also.

Official Tony Romo Jersey Online Store introduces all types of very affordable Sean Lee Jersey straight away with Quickly Delivery service, Protected Payment & First class Support Services.

Filed: Sports and Fitnesspatricia heaton arsenic and old lace leslie varez ward solar storms uganda the parent trap

VN:F [1.9.20_1166]

Rating: 5.0/5 (1 vote cast)

Cholesterol is a waxy substance that tends to stick to our blood vessels and makes the blood flow difficult through the vessels. In extreme cases, when the cholesterol levels reach quite high, the blood vessels completely choke the flow of blood which leads to cardiac arrest and mostly proves fatal.

Cholesterol is a waxy substance that tends to stick to our blood vessels and makes the blood flow difficult through the vessels. In extreme cases, when the cholesterol levels reach quite high, the blood vessels completely choke the flow of blood which leads to cardiac arrest and mostly proves fatal.

However, all cholesterol is not bad. In fact our body requires some amount of cholesterol for production of hormones and performing some other important body functions. Basically, there are two types of cholesterol ? LDL (low density lipoprotein) and HDL (high density lipoprotein).

HDL is good for our health and LDL is bad. When our blood test reveals high levels of cholesterol than it means that LDL cholesterol has become higher in blood stream and hence needs to be checked. There are certain foods that can help you control cholesterol levels.

Fiber has proven to be highly effective in lowering bad cholesterol levels in the body. Soluble fiber especially helps in lowering bad cholesterol as it forms a gel like substance in the body and traps the bad cholesterol. Sources of soluble fiber include oats, unrefined grains, apples, beans, kidney beans, barley, prunes, bananas, etc.

Fish is good for overall health and is particularly useful in lowering bad cholesterol levels in the body. Eating fish helps in reducing atherosclerotic plaque levels, blood fats, etc. Fish contains omega ? 3 fatty acids, which helps in reducing high blood pressure levels and the risk of developing blood clots.

Doctors recommend eating three or more servings of fish every week. Baked or grilled fish is a healthier option as compared to fried fish as frying adds unhealthy fats to the dish. High amounts of omega-3 fatty acids are found in mackerel, trout, salmon, sardines, tuna, etc. Otherwise, any variety of local fish is also good for health.

Though nuts are high in calories but eating them in moderate quantities helps in lowering cholesterol levels and keeping blood vessels healthy. Rich in polyunsaturated fatty acids, nuts can keep you full for longer time and also provide a host of nutrients to the body.

It is important to ensure that you eat only a handful of nuts on daily basis as overeating can lead to weight gain. It is also important to avoid salted or sugar coated nuts. Eating plain nuts in their natural form is the healthiest bet.

Olive oil is the only oil which is compressed from fresh fruit otherwise all other types of oils come from seeds. It is the only oil which contains a host of antioxidants including vitamin E and monounsaturated fatty acids that lower LDL cholesterol but does not affect HDL cholesterol.

Extra virgin olive oil is the healthiest option among all the variants of olive oil but it should not be cooked. It should be used in salads, basting meat and other foods, as a substitute of butter on bread slice, etc. You can use pomace olive oil or refined olive oil for cooking purpose. Since olive oil is high in calories it should be consumed in moderate quantities. Two table spoons a day is enough for an adult person, provided all other oils are replaced by olive oil.

Low fat dairy products are high in calcium, protein and lactobacillus microorganisms. These nutrients and minerals are very important for overall good health and well being and may help in reducing bad cholesterol levels.

Removing fat from dairy products virtually removes all the cholesterol also from these dairy products and hence makes it appropriate for low cholesterol diet.

Fruits and vegetables contain lots of vitamins, minerals, antioxidants and fiber. Fruits and vegetables which contain vitamin A and C are particularly useful in lowering bad cholesterol levels. Sources of vitamin C rich foods include lemons, oranges and other citrus fruits, chilies, gooseberry, blackberry and all other berries.

Sources of vitamin A include pumpkin, sweet potatoes, carrots, eggs, milk, etc. If you suffer from heart disease than make sure that you eat five portions of fruits and vegetables on daily basis to get all the essential nutrients without upping your calorie intake.

Home Remedies for Cholesterol

Healthy Foods: Foods that Keep Your Cholesterol Levels at Check

Best Foods to Reduce Cholesterol

Effective Diet Containing Low Cholesterol

Diet that Can Radically Reduce Your Cholesterol Levels

Onions and garlic have traditionally been used in Asian countries as a preventive medicine for heart ailments. Including onions and garlic in your diet, either cooked or raw, can provide you lots of heart healthy nutrients and can help in lowering high cholesterol levels. You can also eat a raw clove of garlic as first thing in the morning to prevent any kind of heart diseases and purify impurities from blood.

Beans and legumes are high in protein and soluble fiber and low in calories. Eating beans and legumes can help you in lowering bad cholesterol levels as it controls hunger pangs and its soluble fiber traps LDL cholesterol in the body.

Researchers have proved that eating foods high in plant sterols can decrease cholesterol levels significantly. Natural sources of these antioxidants include vegetable oil, nuts, legumes, whole grains, fruits and vegetables. Fortified products like milk, cheese, bread contains more concentrated forms of these antioxidants.

Whole grains contain the outermost layer or shell called bran. Bran is rich in minerals, B vitamins, iron and fiber and low in fat and cholesterol. This makes it highly effective in reducing cholesterol levels. Some whole grains like wheat have high insoluble fiber content which helps in regulating glycemic index in body while some other grains like oats have high soluble fiber content which helps in lowering high cholesterol levels. Try to switch over completely from refined grains to whole grains. Eat a variety of whole grains on a regular basis to keep your cholesterol levels in check.

Lastly remember that if you are on a low cholesterol diet than you do not need to cut out all your favorite foods. You can occasionally have a small portion of your favorite foods. Making a ground rule, like eating a serving of high fat foods every Sunday is fine. It will help you savor your favorite food without bingeing. Besides, eating these healthy foods in generous portions on daily basis will help in balancing out your weekly treat.

Photo Credit:?http://www.umm.edu/patiented/articles/000551.htm

10 Foods That Control Cholesterol, 5.0 out of 5 based on 1 ratingSource: http://www.ayushveda.com/magazine/10-foods-that-control-cholesterol/

buffalo chicken dip soul train nevada caucus ufc 143 what time does the super bowl start super bowl 2012 josephine baker